There has been a dizzying array of governmental assistance offered as a result of the worldwide COVID-19 crisis. Right now it kind of feels like a feeding frenzy, with justifiably-worried business owners and employees figuring out how to make ends meet when sales have fallen through the floor.

Scary times.

Knowing that there is governmental assistance available is step one. Understanding the programs, their advantages, disadvantages, and processes is step two. And finally executing on a plan to utilize the programs is step three.

These articles are here to help these steps.

You might be asking why publish yet another article when anyone adjacent to a public accounting firm has probably received a lengthy email from their local CPA on what these programs are, or when there are folks on LinkedIn touting their services.

Two Reasons:

- A lot of these CPAs assume they are talking to other well-practiced CPAs when they write this advice. They do not distill it in language the rest of the world speaks.

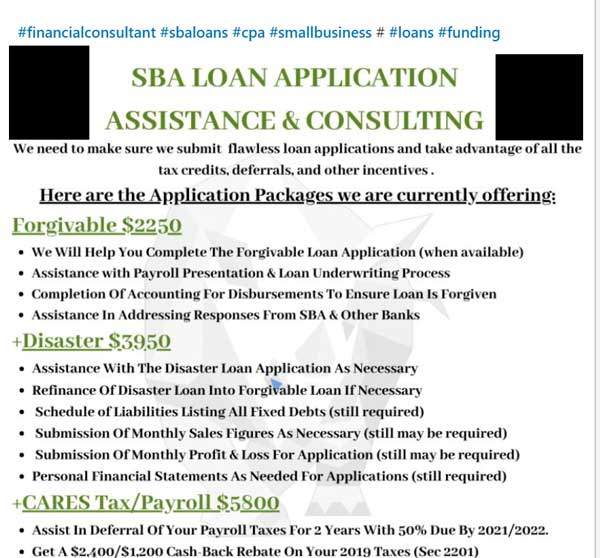

- Products and Services like this:

Now is not the time to get into the ethics of profiteering from a disaster that is very painful for a lot of people not just in the United States but around the world. I believe everyone should grab as much of the pie as they can get their hands on so long as they don’t hurt anyone else in the process.

However, this is not the kind of business that I run and I don’t want to be “that guy.”

So consider this my effort to democratize the information and understanding of these programs such that the market naturally reacts in a way such that services like the above, which while valuable in the short-term are not the type of long-term relationship building I am about, don’t carry such premium prices with them.

OK, now to step off my soapbox and actually talk about what all these programs are.

In broad terms, there are three major areas the government is helping business.

I am going to briefly explain these below, and then expound on each area more fully in subsequent articles. This is a lot of information to throw out there at once, and so to understand it all it’s best to break it up into chunks. Keep in mind this is a summary and there is a greater deal of nuance and stipulations to these programs, so the next step after reading this summary is to dive in deeper, not party like it’s 1999 in anticipation of some windfall.

Loans

We all know what a loan is. The government loan programs are attractive because they offer low interest rates, in some cases no or low collateral amounts, and in some cases the government may even forgive part or all of the loan should you meet certain conditions! Here are the two major programs businesses are utilizing

1. Economic Injury Disaster Loans: These are provided by the Small Business Administration (SBA), a unit of the Federal government. These actually existed before the COVID-19 crisis. The amount you can borrow is limited to $2 million, collateral is required for loans over $25,000 and the borrower must sign a personal guarantee (meaning if the company doesn’t pay, the owner/manager who signs the guarantee pays) for loans over $200,000. Maximum interest rate is 4%.

2. Payroll Protection Loans: These are a new offering as a result of the Coronavirus Aid, Relief, and Economic Security Act (CARES Act). The loans are originated by participating banks, not by the SBA. Employers are allowed to borrow a multiple of their payroll over the last 12 months. The government, in an effort to keep businesses employing the same number of people, keep paying the same wages, and keep spending on things like mortgages, rent and utilities, will forgive some/all of the loan to extent the business keeps spending on these things in the eight weeks after the loan is originated. When I say forgive, yes, this means exactly what it sounds like: it means borrowing the money but never having to pay it back.

Tax Credits

Before we get into the specifics of the programs, let’s make sure we understand what is a tax credit.

Think of a tax credit as a “substitute” for a cash payment to the government for taxes. So let’s say you owe the government $100. You can either write them a $100 check, or you can utilize tax credits, which count as payments against that $100 all the same (in practice most people pay off their taxes by mixing the two methods). In some cases, you might owe the government $100 in taxes but have $120 in credits, in which case you may actually get $20 back! Not all credits work the same; when you can actually get back more than you owe, this is called a refundable tax credit.There are many, many ways to get tax credits. For example, with the Child Tax Credit, if you have children of a certain age (and meet other stipulations), the government just gives you a tax credit of $2,000 per child to use against your individual taxes. There is an Energy Tax Credit as well, which is when you buy, for example, qualifying appliances (like ones labelled with the Energy Star logo). When you buy and install such appliances, part of the cost you paid for the appliance may be claimed as a tax credit on your individual taxes.More specific to our current situation, the government is offering tax credits if you, as a business, do one of two things: 1) continue paying people who cannot come into work due to their own conditions related to COVID-19, or are caring for someone in a COVID-19 situation, or cannot come in due to caring for children who cannot go to school/daycare due to quarantine/stay-at-home orders, or 2) continue employing people through January 1, 2021 even if your business suffers a major loss in sales compared to 2019.

1. Paying people on sick or child care leave: This is a provision of the Families First Coronavirus Relief Act (FFCRA). Under this act, many employers are mandated to continue paying people who cannot come into work. To offset the cost, the government is allowing people to claim a portion of the payments to folks on sick or child care leave as a tax credit. And rather than wait until year-end to claim the credits, there are provisions to realize them immediately. Cash is tight right now and it would appear the government has recognized this and provisioned accordingly.

2. Employee retention: Another provision of the CARES Act. The Employee Retention Credit provides for business that have suffered a significant decrease in year-over-year sales (ie 2020 vs. 2019) but continue to employee people. The credit is based on how much you pay each employee during the period that starts when your business suffers that decline in sales, and ends when sales have recovered to a certain level compared to 2019. You measure how much you paid each employee during this period, up to $10,000/employee, and receive a credit for 50% of that amount, or $5,000. Like the FFCRA sick/child care leave provisions, there are also provisions of this credit that allow immediate realization of the credit rather than having to wait until year-end to claim the credit.

Two important notes about these credits:

- You cannot claim the same wages for both credits. No double-dipping

- If you utilize the employee retention credit, you cannot also utilize the payroll protection loan, mentioned above

Payroll Tax Deferrals

The last offering comes under the CARES Act. Under this provision, employers who do not take advantage of the Payroll Protection Program described in 1b above, have the option of deferring payment of payroll taxes – specifically the employer share of social security tax.Let’s take a step back and understand what this tax is. Every dollar of wages paid to an employee carries with it a 12.4% social security tax. Half of this, 6.2%, is taken out of the employee’s paycheck, with the other half paid by the employer. Depending on how big an employer’s payroll is, this tax is payable to the IRS the next day after payroll, within two weeks of the payroll, by the 15th of the month following the payroll, or by the end of the month following the payroll – yes, it can be that complex.Under the CARES deferral program, payment of the employer share of the 6.2% may be deferred (ie postponed). This applies to the social security tax that arises out of any payrolls paid between March 27, 2020 and December 31, 2020.Half of the amount deferred must be paid by December 31, 2021, and the remaining half must be paid by December 31, 2022.This stipulation was mentioned above, but is very important so I’ll reiterate: if you take advantage of the Payroll Protection Loan mentioned in 1b earlier in this article, you cannot also defer your payroll taxes under this provision. One or the other.

Phew, that was a lot to go through. And this was supposed to be the summary article! I genuinely hope that this distilled a lot of the technical specifications into something more digestible to non-lawyers and non-accountants. If you can walk away from reading this being more aware of the types of assistance the government is offering, and the general activities you have to engage in to utilize that assistance, then this will have been time well spent.

In future articles, we will dig more into the specifics of the programs – how all this stuff is calculated, what forms have to be filled out, and so on and so forth. Until then, May you be happy; may you be well; may you be comfortable, and at peace.